Let's look at our differing interpretations of the trajectory of the great depression after '33. I'm going to use actual economic data:

See what happens to unemployment once FDR is elected? There is a short bump in unemployment in '37, but it is immediately corrected as unemployment again plummets. The U.S. actually didn't get involved directly in WWII until December of '41 ("December 7th, 1941, a date which will live in infamy..."). If you want to claim lend-lease helped, that was a Keynesian economic policy. When FDR started in office you had the horrors of the Okies as described in The Grapes of Wrath, and by '42, the U.S. was literally importing farmworkers to keep up with job demand through the bracero program.

It should also be noted that between '29 and '33 Hoover practiced the "leave it to the states and balance the budget" approach to fixing the economy, and look at what happened to unemployment! Through the roof!

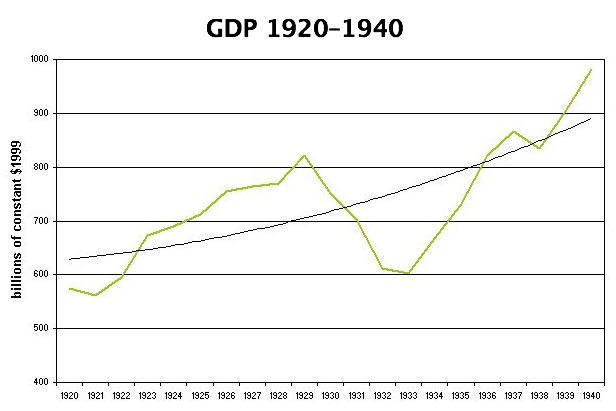

Now, do you want to say that those employment numbers don't reflect real economic growth? How about the GDP?

Again, look what happens under conservative Paul-like policies? It plummets. FDR comes in and it goes through the roof. Again there is the slight bump in '37, but again it recovers quickly and outdoes itself. And this chart doesn't even show U.S. involvement in World War II. Also note, this chart is adjusted for inflation, meaning that it reflects real economic growth.

In that clip Paul claims there was no real recovery occurred until we paid down the deficit, but that's garbage, as the charts reflect. Although it was a long road to recovery, we would have never paid down any deficit if it weren't for the fact that FDR got people working again, got factories producing again, and readied America to be an arsenal to the world so that it could eventually have the economic viability to pay down its national debt.

If you want to see some real insane bullshit about how bad it can get, again, I refer you to the gilded age.

You can throw out all the theoretical philosophical bullshit you want, but I prefer empiricism. I judge what works economically by how it actually plays out in the real world under actual market circumstances, Paul's utopia is a non-plutocrat's nightmare, no matter how many different explanations you can come up with for why its not, it simply puts too much unstable power in the hands of the investment class, and results in shit like black friday in 1869, or the crashes in 29 and 89 at least.

As far as Obama's current economic policy goes, I'm a left critic. I believe in an FDR type approach and think there needs to be serious keynesian spending in order to stimulate the economy in the form of direct relief, not corporate welfare, as well as a 3 pronged approach that focuses on direct relief, economic recovery, and reform of an economic system that has run wild and become unstable. One thing I think he could start with is a break up of the "too big too fail" banks.

Topic: John Fitzgerald Off Zero (Read 135298 times)

Topic: John Fitzgerald Off Zero (Read 135298 times)